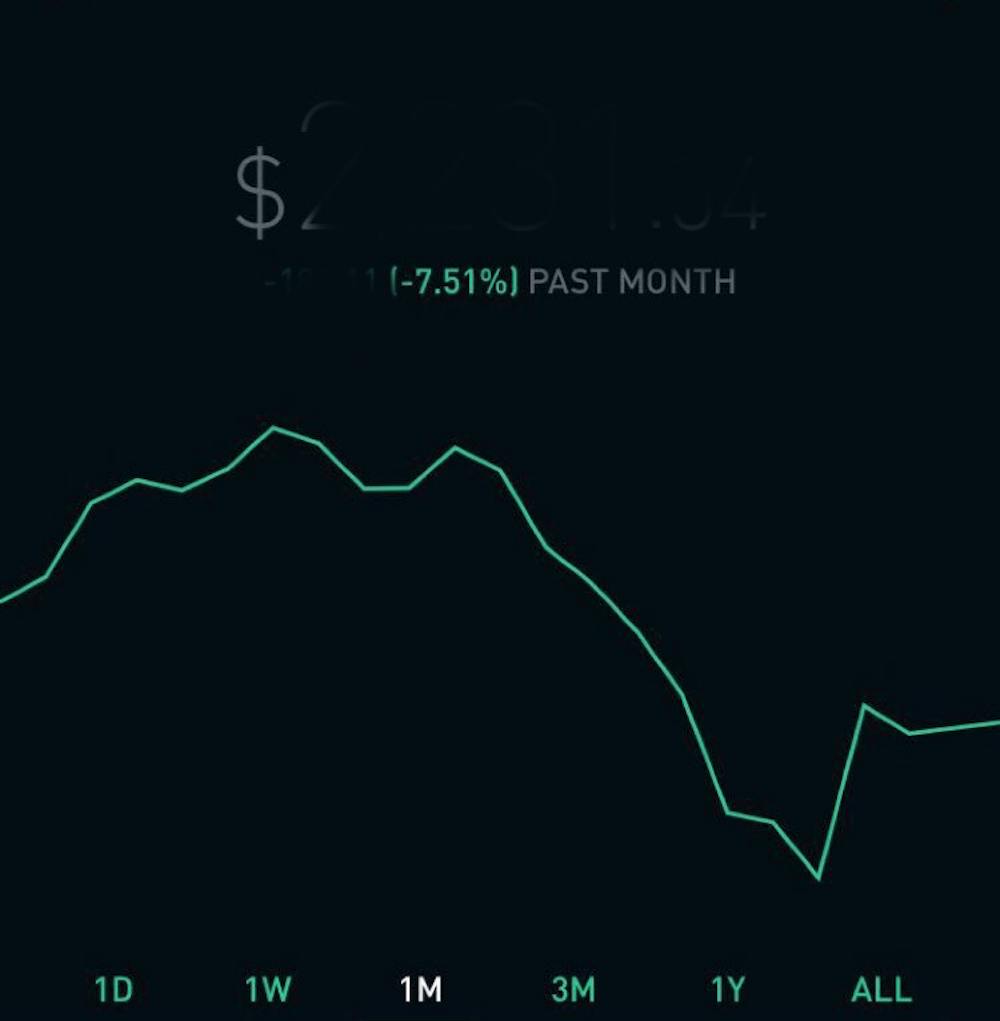

Zicheng Ye painfully watched as the stock market plunged over the span of a few minutes on Feb. 5. He is a senior economics major who created his investment portfolio four months ago to help him learn the real market.

Ye was among millions of retail and institutional investors who were heartbroken that day when the Dow Jones Industrial Average plummeted to its lowest point decline in history — dropping 1,597 points around 3 p.m. — and the S&P 500 significantly fell from 113.19 points to 2,648.94 at the end of the day.

Ye lost over 10 percent of his portfolio.

The plunge was much less significant on a percentage basis, but was still a hard lesson for student investors, like Ye, to learn. It had immense impacts on their collective psyche, and many, including Ye, have retreated from the volatile market to their savings accounts.

“I quit the market,” Ye said. “It fluctuates a lot these days. I will wait until it becomes stable, and it also takes time to pick the right stocks or (exchange-traded funds).”

Ye still thought the unanticipated market plunge was reasonable, considering the earlier over-performance of the market.

“There was a sign on Friday,” Ye said. “I sold all stocks, but forgot to cancel one pending transaction.”

Ziyu Liao, a junior who has been investing in the market since high school, shared a similar perspective. He said early signs could be traced to Feb. 2 when the Labor Department reported the 2.9 percent jump in annualized earnings, indicating that the Federal Reserve would take an aggressive stance on interest rate hikes in order to control the inflation.

“If you look at the interest rate side, you get people who were upset about the interest rate hike, which, of course, implied that the future discount rate of cash flow, and that means companies were less valuable because you squeeze your opportunity cost to capital,” Liao said.