A local real estate agent is offering a product to educate homeowners about alternatives to foreclosure, which she predicts will be a growing problem in Orange County in the coming months.

Jodi Bakst, a broker with Team Jodi, a group of real estate experts who specialize in Chapel Hill and Durham properties, created a website which lists the pros and cons of all the options homeowners have when they default on a mortgage.

“Next year, mortgages are going to reset, and so I’m focusing on foreclosure solutions because we are going to see more numbers in the short run,” Bakst said.

When a homeowner initially takes out a mortgage, interest rates and monthly payments are relatively low, Bakst said. But when the mortgage resets, interest rates increase, pushing up payments as well.

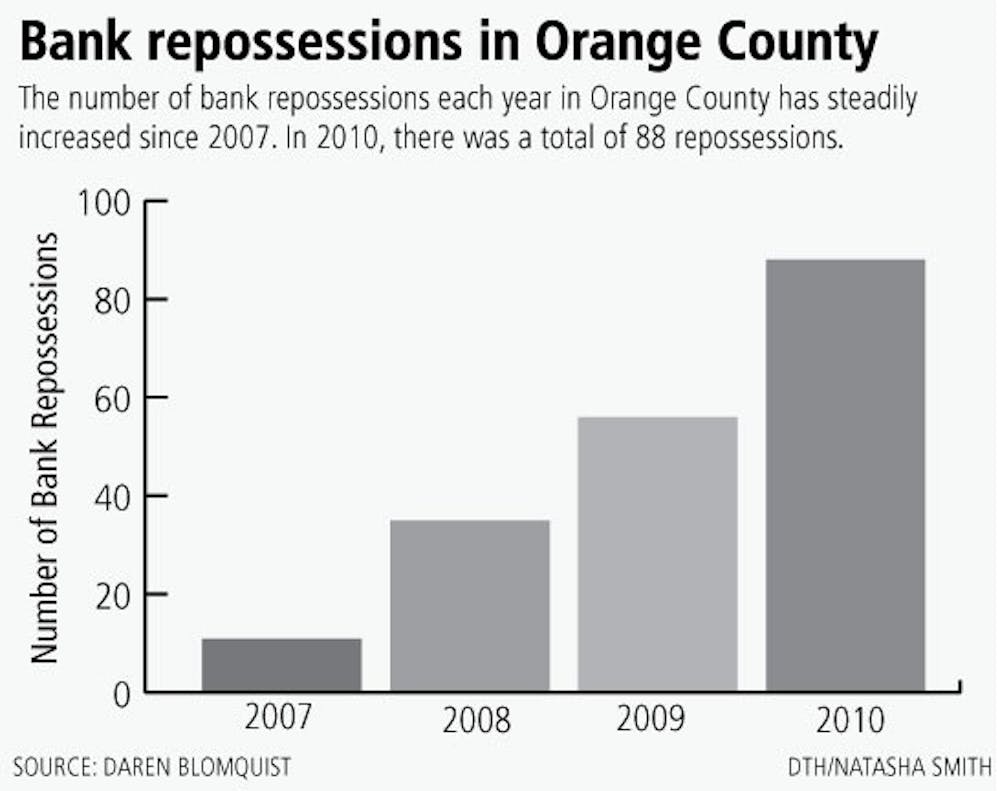

There were 88 foreclosures in Orange County in 2010, compared to 11 in 2007, according to RealtyTrac, an online marketplace of foreclosure properties that uses public records to list bank-owned properties in over 2,200 counties.

Daren Blomquist, spokesman for RealtyTrac, said while other areas were hit harder early in the national mortgage crisis, Chapel Hill will likely see an increase in foreclosures next year as mortgages reset.

“There is a risk that some people who were not hit by foreclosures early on will be hit with them now,” he said.

Blomquist said mortgage resets generally take place every five years.

Of the many foreclosure solutions that Bakst has on her website, short sales are the best option for many homeowners, said Tim Burrell, a real estate broker at Re/Max United in Raleigh.