McCrory said in a statement last week that the state is now projected to pay off its debt to the federal government by August 2015. Original estimates had the state paying off its debt by November 2015.

North Carolina incurred its unemployment debt after the state’s funds for unemployment benefits ran out in 2009 during the economic recession.

The state ranked sixth nationally for highest unemployment debt in August 2011 before the federal stimulus package ran out and the state had to begin paying interest on its loans. When McCrory took office in January 2013, the debt stood at $2.5 billion, McCrory said in his statement.

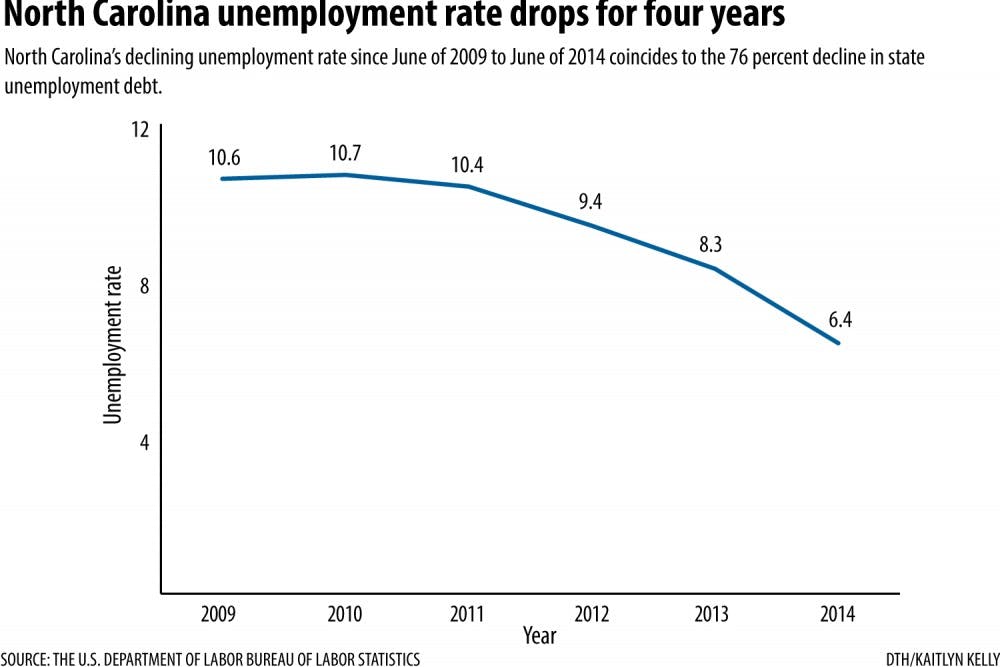

The new debt numbers coincide with North Carolina’s declining unemployment rate, which dropped from 10.7 percent in June 2010 to 6.4 percent in June 2014.

In a May report, state lawmakers said the lower debt can be attributed to a variety of factors, including an increase in the unemployment tax on businesses — which had been cut before the recession . Changes to the unemployment benefit policy also contributed to the lower debt.

Those changes consisted of major reductions to the state’s benefit payments to the unemployed, said Patrick Conway, chair of the UNC economics department.

The N.C. General Assembly in 2013 cut unemployment insurance compensation from $535 per week to $350 per week.

“The trust fund is being repaid, but it’s being reduced by reducing the payout to the unemployed,” Conway said.