Kersten is not alone. Almost half of students who enter college don’t finish their degrees. The most common reason students cite for withdrawing is financial hardship. But a growing number of students are also withdrawing for health reasons.

Roughly 45 percent of these students have no degree to show for their time in post-secondary education, according to the National Student Clearinghouse Research Center. What they do have is massive amounts of debt.

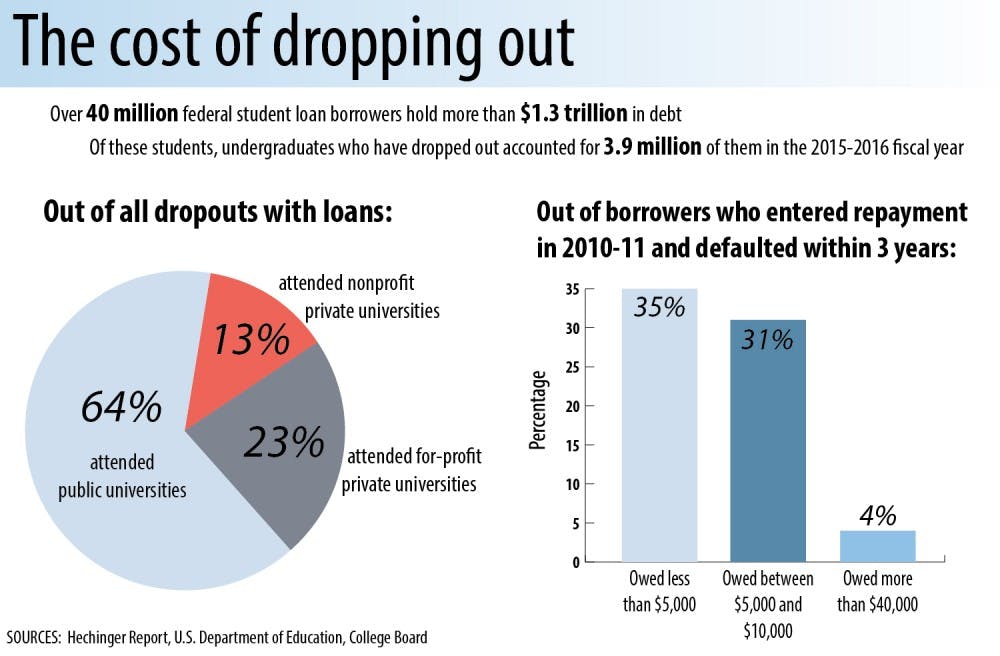

Over 40 million federal student loan borrowers together hold more than $1.3 trillion in debt — the nation’s highest amount of student loan debt to date. Undergraduates who have dropped out accounted for 3.9 million of these students in the 2015-16 fiscal year.

For-profit universities produce the most indebted college dropouts – accounting for 23 percent — but only 10 percent of college students in the country attend these universities.

Opponents of for-profit universities that overcharge students, like the liberal-leaning youth advocacy group Young Invincibles, say many of these institutions leave students with loans they can’t pay back. In December 2017, U.S. Secretary of Education Betsy DeVos faced criticism for significantly rolling back loan forgiveness rates for students holding debt from fraudulent for-profit university programs, such as ITT Technical Institute and American Career Institute.

“The Department of Education under Secretary DeVos has routinely shaped policy to benefit institutions and businesses that profit off of students and borrowers,” Erin Steva, the midwest director of Young Invincibles, said in a press release.

According to The Hechinger Report, an analysis of data from the U.S. Department of Education shows public universities account for 64 percent of college dropouts.

Nonprofit, private universities account for 13 percent of college dropouts, although they only account for 25 percent of all enrolled undergraduate students. Dropouts from private universities hold the highest amount of debt – averaging about $10,000 in debt.

Eric Johnson, a spokesperson for UNC’s Office of Scholarships & Student Aid, said students who leave school without a degree are most likely to struggle with repayment.

These students are four times more likely to default on loan payments than student who have graduated, according to a study by Education Sector, a non-partisan think tank that analyzes education policy.

Kersten said the way college loans work in the United States is not ideal.

"I think that the system puts a lot of undue stress on students," she said. "I feel like I'm doing what I need to do for me, but it's still very stressful."

To get the day's news and headlines in your inbox each morning, sign up for our email newsletters.

According to the Federal Student Aid Office of the U.S. Department of Education, UNC-Chapel Hill has one of the lowest rates of defaulted college loans in the country, with less than 2 percent of borrowers defaulting in the 2012-13 school year.

Although Kersten said her situation has been stressful, she has had a positive experience with UNC in both the processes of withdrawing and repayment. She found the academic counselors helpful and encouraging of her decision to take time off and appreciated the school's willingness to set up a payment plan.

"They told me I could come back whenever, that they had people come back in their 80s and finish their degrees."

@MitraNorowzi

state@dailytarheel.com