Students have felt the impact of the current economic state in their own lives — high inflation affects students just as it does the rest of the American public. In fact, students are often hit harder.

Students of color, first-generation students and socioeconomically-disadvantaged students have felt economic disparities more severely than the rest.

The U.S. has had a declining gross domestic product for two straight quarters. According to the U.S Bureau of Economic Analysis, the country's GDP in quarter one of 2022 decreased at an annual rate of 1.6 percent, with GDP in quarter two decreasing at an annual rate of 0.6 percent. A six-month (or two-quarter) contraction period is the informal definition of a recession.

Informally, America is currently in a recession.

High inflation is raising the costs of students’ necessities, such as housing, food and transportation. Additionally, this extended inflation has the potential to drive up the cost of tuition.

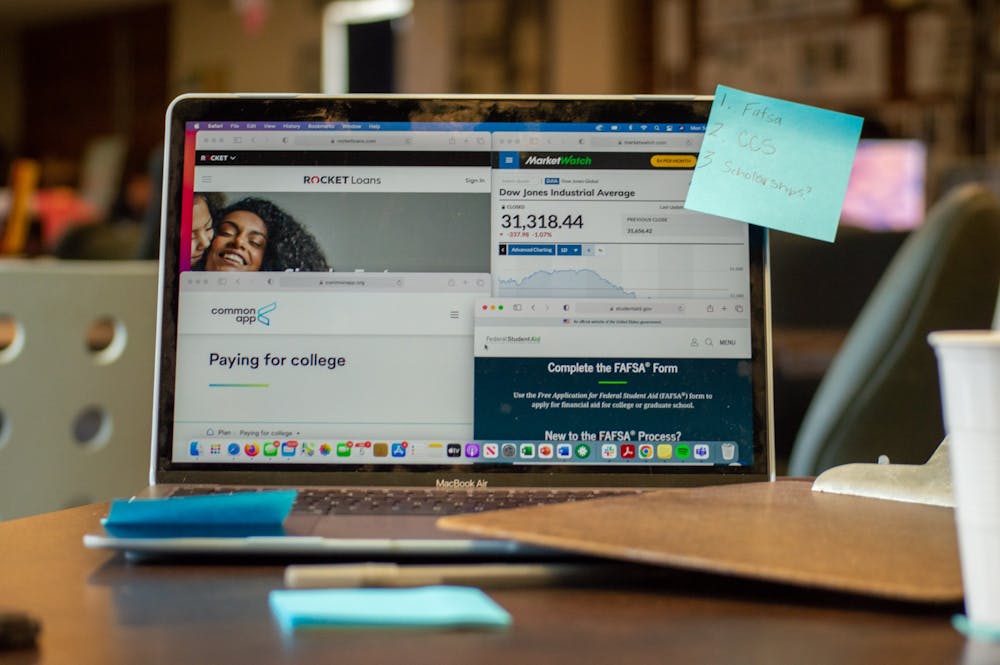

This leads to a chain reaction of financial pressures. With higher tuition costs, students will have to borrow more money. And the interest rates on student loans will be higher because of the federal rate hikes on loans.

The student loan interest rate for the 2022-2023 year has already risen to 4.99 percent, up from the 3.73 percent that it was last year.

Tuition costs and inflation rates increase while grant budgets and financial aid awards do not, resembling the current conversation surrounding prices going up and wages remaining the same.

The advice offered to students is the same advice they’ve heard for years: “learn how to stretch a dollar, spend a little less, make a little more and make sure to have a budget.” While this advice is helpful, the current economy and outrageous cost of higher education have caused these efforts to go in vain.